Harrison County Texas Sales Tax Rate . 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. the current total local sales tax rate in harrison county, tx is 6.250%. This is the total of state, county, and city. There are a total of 966 local tax. welcome to the new sales tax rate locator. the current sales tax rate in harrison county, tx is 8.25%. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. In the tabs below, discover new map and latitude/longitude search options. Click for sales tax rates, harrison county sales tax calculator, and. 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. The december 2020 total local sales tax rate. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. notice for 2024 tax rates.

from www.signnow.com

There are a total of 966 local tax. notice for 2024 tax rates. This is the total of state, county, and city. the current sales tax rate in harrison county, tx is 8.25%. 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. Click for sales tax rates, harrison county sales tax calculator, and. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. the current total local sales tax rate in harrison county, tx is 6.250%. welcome to the new sales tax rate locator. The december 2020 total local sales tax rate.

Texas Tax Rate 20152024 Form Fill Out and Sign Printable PDF

Harrison County Texas Sales Tax Rate the current total local sales tax rate in harrison county, tx is 6.250%. The december 2020 total local sales tax rate. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. In the tabs below, discover new map and latitude/longitude search options. the current sales tax rate in harrison county, tx is 8.25%. 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. welcome to the new sales tax rate locator. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. This is the total of state, county, and city. Click for sales tax rates, harrison county sales tax calculator, and. There are a total of 966 local tax. notice for 2024 tax rates. the current total local sales tax rate in harrison county, tx is 6.250%.

From dxorzthcy.blob.core.windows.net

Is There A Sales Tax In Texas at Edward Sargent blog Harrison County Texas Sales Tax Rate the current total local sales tax rate in harrison county, tx is 6.250%. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. In the tabs below, discover new map and latitude/longitude search options. Click for sales tax rates, harrison county sales tax calculator, and. 126 rows in texas, 123 counties impose a county sales. Harrison County Texas Sales Tax Rate.

From exovplwdf.blob.core.windows.net

How To Calculate Sales Tax On A Car In Texas at Sean Harvey blog Harrison County Texas Sales Tax Rate harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. The december 2020 total local sales tax rate. the current total local sales tax rate in harrison county, tx is 6.250%. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. welcome to the new sales tax. Harrison County Texas Sales Tax Rate.

From www.aarp.org

States With Highest and Lowest Sales Tax Rates Harrison County Texas Sales Tax Rate 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. the current sales tax rate in harrison county, tx is 8.25%. notice for 2024 tax rates. Click for sales tax rates, harrison county sales tax calculator, and. There are a total of 966. Harrison County Texas Sales Tax Rate.

From zamp.com

Ultimate Texas Sales Tax Guide Zamp Harrison County Texas Sales Tax Rate The december 2020 total local sales tax rate. notice for 2024 tax rates. the current sales tax rate in harrison county, tx is 8.25%. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. There are a total of 966 local tax. the current total local sales tax rate in harrison county, tx is. Harrison County Texas Sales Tax Rate.

From texascountygisdata.com

Harrison County, TX GIS Shapefile & Property Data Harrison County Texas Sales Tax Rate the current sales tax rate in harrison county, tx is 8.25%. 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. welcome to the new sales tax rate locator. There are a total of 966 local tax. Click for sales tax rates, harrison. Harrison County Texas Sales Tax Rate.

From mungfali.com

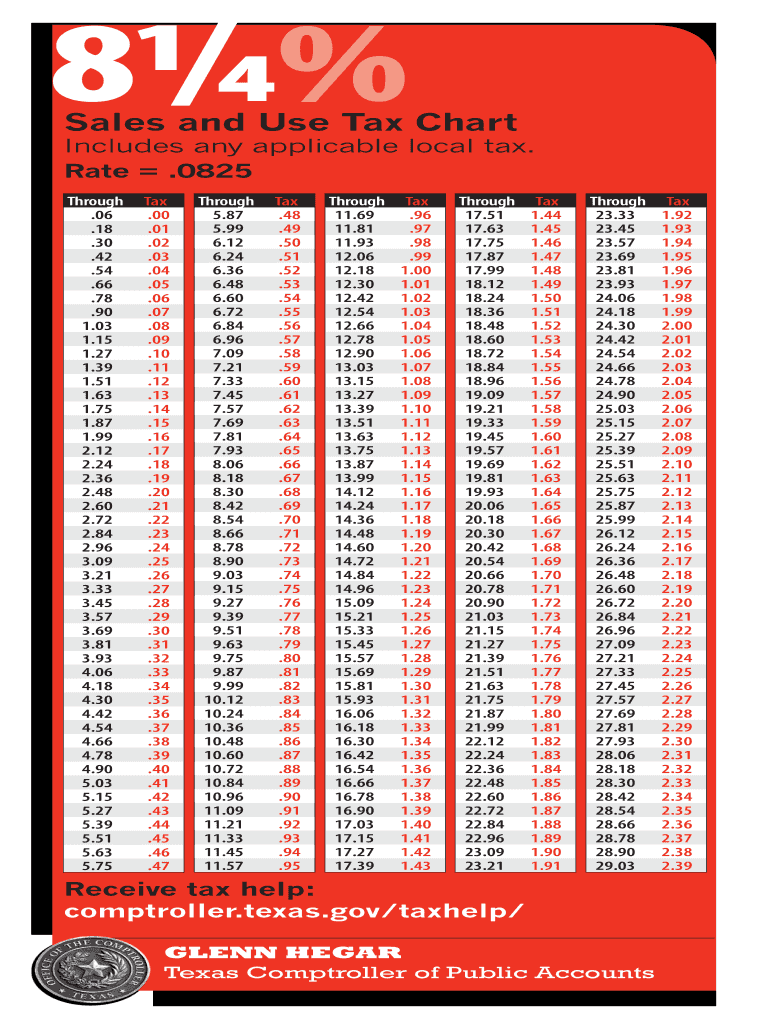

Texas Tax Chart Printable Harrison County Texas Sales Tax Rate the current total local sales tax rate in harrison county, tx is 6.250%. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. Click for sales tax rates, harrison county sales tax calculator, and. 126 rows in texas, 123 counties impose a county sales and use tax for property tax. Harrison County Texas Sales Tax Rate.

From mungfali.com

Texas Sales Tax Chart Printable Harrison County Texas Sales Tax Rate The december 2020 total local sales tax rate. the current sales tax rate in harrison county, tx is 8.25%. There are a total of 966 local tax. welcome to the new sales tax rate locator. 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. the minimum combined 2024. Harrison County Texas Sales Tax Rate.

From taxfoundation.org

State and Local Sales Tax Rates, Midyear 2021 Tax Foundation Harrison County Texas Sales Tax Rate The december 2020 total local sales tax rate. Click for sales tax rates, harrison county sales tax calculator, and. 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. There are a total of 966 local tax. harrison county, texas has a maximum sales. Harrison County Texas Sales Tax Rate.

From printablemapaz.com

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas Harrison County Texas Sales Tax Rate 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. the current sales tax rate in harrison county, tx is 8.25%. This is the total of state, county, and city. welcome to the new sales tax rate locator. notice for 2024 tax rates. the minimum combined 2024 sales. Harrison County Texas Sales Tax Rate.

From editheqcharmain.pages.dev

Texas Sales Tax Rate 2024 Jeanne Maudie Harrison County Texas Sales Tax Rate the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. the current total local sales tax rate in harrison county, tx is 6.250%. In the tabs below, discover new map and latitude/longitude search options. the current sales tax rate in harrison county, tx is 8.25%. 126 rows in texas, 123 counties impose a county. Harrison County Texas Sales Tax Rate.

From quickbooks.intuit.com

Texas Sales Tax Automatic Calculation Wrong Harrison County Texas Sales Tax Rate In the tabs below, discover new map and latitude/longitude search options. 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%.. Harrison County Texas Sales Tax Rate.

From pdeastmanbook.blogspot.com

Texas Sales Tax Rate Tax Sales Tax Sales Chart And if you’re Harrison County Texas Sales Tax Rate the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. the current sales tax rate in harrison county, tx is 8.25%. the current total local sales tax rate in harrison county, tx is 6.250%. There are a total of 966 local tax. The december 2020 total local sales tax rate. In the tabs below, discover. Harrison County Texas Sales Tax Rate.

From csvsalestaxtable.com

State Sales Tax Rates 2023 Your Comprehensive Guide Harrison County Texas Sales Tax Rate 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. This is the total of state, county, and city. notice for 2024 tax rates. 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. In the. Harrison County Texas Sales Tax Rate.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation Harrison County Texas Sales Tax Rate notice for 2024 tax rates. the current sales tax rate in harrison county, tx is 8.25%. welcome to the new sales tax rate locator. Click for sales tax rates, harrison county sales tax calculator, and. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%. the current total local sales tax rate in. Harrison County Texas Sales Tax Rate.

From quizzdbbackovnc.z13.web.core.windows.net

State And Local Sales Tax Rates 2020 Harrison County Texas Sales Tax Rate Click for sales tax rates, harrison county sales tax calculator, and. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. 126 rows in texas, 123 counties impose a county sales and use tax for property tax relief. the minimum combined 2024 sales tax rate for harrison, texas is 8.25%.. Harrison County Texas Sales Tax Rate.

From valeriewcheri.pages.dev

Austin Tx Sales Tax 2024 Yetta Katerine Harrison County Texas Sales Tax Rate 1652 rows texas has state sales tax of 6.25%, and allows local governments to collect a local option sales tax of up to 2%. The december 2020 total local sales tax rate. In the tabs below, discover new map and latitude/longitude search options. harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population. Harrison County Texas Sales Tax Rate.

From neilking.pages.dev

Sales Tax Calculator 2025 Texas Neil King Harrison County Texas Sales Tax Rate harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. welcome to the new sales tax rate locator. This is the total of state, county, and city. the current sales tax rate in harrison county, tx is 8.25%. The december 2020 total local sales tax rate. Click for sales tax. Harrison County Texas Sales Tax Rate.

From investomatica.com

United States Sales Tax Rates and Calculators 2024 Investomatica Harrison County Texas Sales Tax Rate harrison county, texas has a maximum sales tax rate of 8.25% and an approximate population of 41,950. the current sales tax rate in harrison county, tx is 8.25%. There are a total of 966 local tax. the current total local sales tax rate in harrison county, tx is 6.250%. welcome to the new sales tax rate. Harrison County Texas Sales Tax Rate.